So the recent report that the second quarter Gross Domestic Product only contracted by 1% instead of the very nasty drop of around 6% in the first quarter should result in a smaller increase in the unemployment rate. Of course, the change in GDP does not effect the unemployment rate immediately. There is a lag time.Growth and unemployment

A few commenters have asked how it’s possible to have a recovery with rising unemployment; also there seems to be some confusion about what I meant by saying that the unemployment rate isn’t much out of line. So I thought I’d offer a chart — and I learned something in the process.

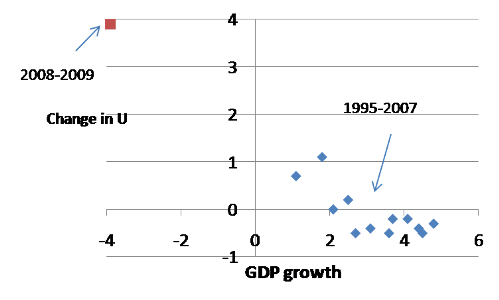

So here’s what economists mean when they talk about “Okun’s law” (which, like almost everything in economics, is a rough rule of thumb rather than a true law.) On the horizontal axis is the annual rate of growth in real GDP, on the vertical the change in the rate of unemployment (so that if unemployment goes from 5 to 6 percent, that’s a +1). I start with 1995 because that’s about when there seems to have been a pickup in underlying US productivity growth, making comparisons with earlier years problematic.

What you see is that unemployment tends to fall when growth is high,

fallrise when it’s low or negative. You also see that growth has to be fairly fast — more than 2 percent — just to keep the unemployment rate from rising. Why? Well, productivity is rising, so that you can produce any given level of output with fewer workers; so output has to rise to keep employment from falling. And the working-age population is growing, so you need positive employment growth just to keep unemployment from rising.That’s how you can have a technical recovery that feels like a recession: real GDP may be rising, but if it doesn’t rise at a sufficiently high rate, unemployment keeps going up.

Now, notice the red dot at the upper left. That represents what happened from 2008II to 2009II: a huge fall in real GDP, a huge rise in unemployment.

In my opinion that still means that the economy is improving in a few sectors, especially housing. Those sectors are being "floated" on a sea of government supplied money and credit because the federal government is pumping stimulus money into the economy. The consumption that drives the overall economy is not yet self-sustaining, and gives no indication that it will be anytime soon.

Consumption itself cannot increase or even stop declining until the consumers start getting more money to spend, and they aren't getting it yet. In part that is because there is no increase in wage income, and in part there is a problem that consumers are sensible and want to build or rebuild their savings in case of future problems. Even if they get more money, consumers are going to delay a lot of spending until after they allay their fears of layoff or other job loss. Since Consumption is 70% of the total GDP, and investment that is directed at economic growth caused by an increase in consumption is another big chunks of the 30% of the economy that's left, the economy is not currently improving on its own and will not do so until consumers start making more money.

That means unemployment must drop dramatically, something that will only happen after the GDP has gone into positive numbers. The growth of GDP has to be a sizable one, according to Krugman, And the delay between the time change in GDP actually does turn back into growth until the employers decide it is a permanent or at least predictable change, then the time the employers take to decide to hire more labor and actually get it done, will probably take at least a year or more.

I doubt that the economy could begin to show strong hints that it was starting to be self-sustaining again until Summer of 2010 or later.

This really is the worst economic downturn since the Great Depression of the 1930's. And it has taken nearly a decade to develop, with the signs of the downturn itself not being publicly obvious until late 2006 or early 2007.

The stimulus funds that have already been committed are only about 30% implemented at this time. It is really surprising that the mere 30% has begun to show significant effects this soon.

This link leads to Krugman's earlier post.

No comments:

Post a Comment