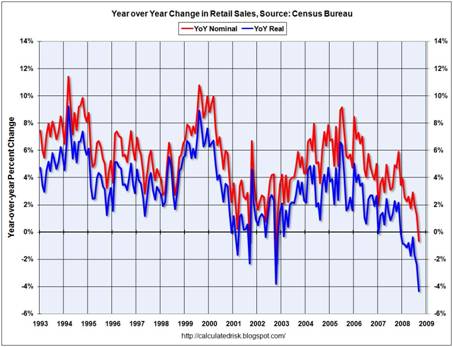

The chart originated at the web site Calculated Risk.

Paul Krugman makes a very important point about the rescue actions that Paulson and the administration are trying to set in place. They have acted too late to keep the economy from going into recession. Here's Krugman's exact quote:

This reinforces a point I’ve been trying to make: even if the rescue now in train succeeds in unfreezing credit markets, the real economy has immense downward momentum. In addition to financial rescues, we need major stimulus programs.What follows is my impression.

Paulson hadn't figured out that the credit crisis that was destroying his beloved Wall Street banks was going to require that he and the Bush administration take over those banks until the British government showed him the way and Paulson watched the market reaction. Even then he did so begrudgingly and with caveats which will probably make it slower and less effect than the bail outs the European bankers are conducting. At least that is what the European reaction to Paulson's actions predicts.

Paulson isn't going to initiate any stimulus actions until it is too late for them to be effective, either. He is a conservative banker who creates and sells deals, not an economic theorist who has a broad understanding of how the economy works and what it takes to change it. The difference in thinking between the two disciplines because obvious when the original "Paulson Proposal" was offered and it became clear that it was a bankers' proposal which no significant economist supported and many actively opposed.

No comments:

Post a Comment